Corporate governance

Basic policy on corporate governance

We acknowledge that enhancing the corporate governance system is one of the most important issues. Based on our mission “Better Systems, Better World”, we strive to strengthen the system within our organization to meet the responsibilities and expectations of stakeholders as a public institution, realize sustainable growth, and enhance our corporate value over the medium to long term.

Corporate governance structure

Overall structure

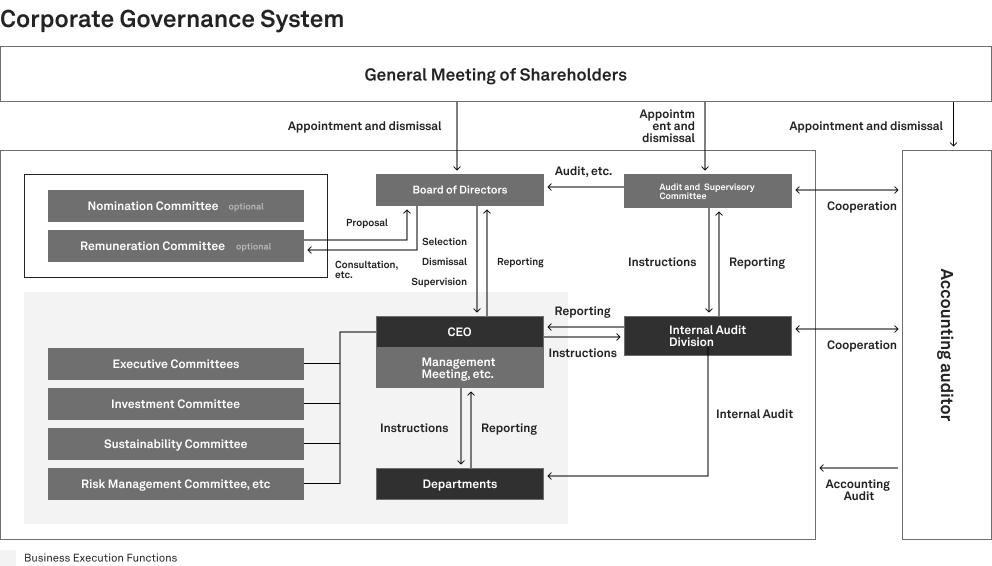

We have adopted the Audit & Supervisory Committee for our corporate governance system.

Board of Directors

In principle, the Board of Directors meets once a month, and extraordinary meetings are held as necessary. In addition to the regular monthly meetings, the Board of Directors, as a management decision-making body, deliberates and decides on matters stipulated in laws and regulations or the Articles of Incorporation as well as other important matters related to management policies, and supervises the execution of duties by each director.

The Board of Directors consists of 8 members, 6 of whom are independent outside directors and 3 of whom are female directors (as of October 24, 2025). The company’s Articles of Incorporation stipulate that the number of directors (excluding directors serving on the Audit & Supervisory Committee) shall be 10 or less.

Audit & Supervisory Committee

The Audit & Supervisory Committee meets once a month in principle, and extraordinary meetings are held as necessary. The Audit & Supervisory Committee exercises its supervisory function by deepening awareness of the current situation and the issues facing the company through active discussions at meetings of the Board of Directors. The Audit & Supervisory Committee also exchanges opinions with the accounting auditor on a regular basis, and receives explanations from the accounting auditor regarding auditing policies and plans, as well as the results of audits on quarterly and full-year financial results. In addition, the Audit & Supervisory Committee exchanges opinions whenever concerns arise regarding individual audits. The Audit & Supervisory Committee also regularly exchanges information with the Internal Audit Division and exchanges opinions on the development and establishment of internal control systems and risk assessment. By sharing information with the accounting auditor and the Internal Audit Division, the Audit & Supervisory Committee enhances the effectiveness of its audits and makes recommendations for corrective actions as necessary.

The Audit & Supervisory Committee consists of 3 members, 3 of whom are independent directors. 1 of them is a certified public accountant who has been engaged in the assurance work of listed companies at an accounting firm for many years and has considerable knowledge of finance and accounting.

Nomination Committee (voluntary committee)

The Nomination Committee, as one of the voluntary committees, is established with a majority of its members being independent outside directors, with the purpose of ensuring objectivity and transparency regarding directors’ compensation. The Nomination Committee is primarily responsible for appointing directors and nominating SVPs who are responsible for execution, and the proposals for the appointment of directors are considered by the Nomination Committee before the resolution by the Board of Directors. Representative Director, President & Group CEO is not part of the Nomination Committee.

Remuneration Committee (voluntary committee)

The Remuneration Committee, as one of the voluntary committees, is established with an independent outside director serving as the chairperson and a majority of its members being independent outside directors, with the purpose of ensuring objectivity and transparency regarding directors’ compensation. It is primarily responsible for designing the remuneration system for directors and SVPs responsible for execution and formulating appropriate remuneration proposals in accordance with the roles of directors. After consideration by the Compensation Committee, director compensation proposals are approved by the Board of Directors together with the proposals for the selection of directors.

Management Meeting, etc.

The company has established companywide Management Meeting as well as management meetings in each business unit as a body responsible for important decision-making in business execution. The Management Meeting is composed of Senior Vice Presidents (SVP) responsible for business execution and deliberates and makes resolutions on important matters related to business execution across the entire company. The meetings in each business unit were established as bodies responsible for important decision-making in business execution in each business unit and are composed of members appointed through deliberation and resolution at the Management meeting.

Board of Directors execution evaluation

The Company’s Board of Directors reviews the overall operation of the Board of Directors at least once a year. For the fiscal year ended July 31, 2024, the following is a summary of the evaluation of effectiveness of the Board of Directors conducted through a survey (total of 23 questions) for directors (including those who are members of the Audit & Supervisory Committee).

- Roles and responsibilities of the Board of Directors

- Size and composition of the Board of Directors

- Deliberations and operations at the Board of Directors

- Institutional design and operation of the Board of Directors and other bodies

- Relationship and dialogue with shareholders

The scores for the questionnaire were generally high, with many respondents stating that its operation was generally appropriate, and we judged that the effectiveness of the Board of Directors has been ensured. There was a significant improvement regarding “the quantity and depth of discussion on the formulation of management strategies,” which was an issue last year. It received positive evaluations, noting that appropriate reporting on the allocation of management resources and capital from a mid-to-long-term perspective was conducted and that vigorous discussions were held. On the other hand, we received comments that there is room for improvement in the decision-making function through more effective involvement in the verification cycle of management strategies.

Election and dismissal of director candidates and determining officers remuneration

Policy and process for selection and dismissal of director candidates

Policy and Process for Selection and Dismissal of Director Candidates In the selection and dismissal of directors, we place importance, without distinction as to gender, age, nationality, etc., on the candidates’ deep understanding and empathy with our management vision and corporate culture, awareness and integrity as a public entity of society, sufficient time and mental capacity to make sufficient contributions to our decision-making and governance, and advanced expertise in their respective fields, The Nominating and Compensation Committee, which is composed of the above-mentioned members, is composed of the following three members. The NominationCommittee formulates candidate proposals in light of the above criteria, and after discussion and approval by the Board of Directors, the candidates are elected at the General Meeting of Shareholders. In addition, the consent of the Audit & Supervisory Committee is obtained prior to submitting a proposal to the Board of Directors for the appointment of directors who are Audit & Supervisory Committee members.

Policy and process for determining officers remuneration

Policy and Process for Determining Executive Compensation Remuneration for directors (excluding directors who are members of the Audit & Supervisory Committee; hereinafter the same) consists of fixed monetary compensation and stock-based compensation based on the following basic policy.

- The remuneration system must function effectively as a medium to long term incentive for continuous growth of corporate performance and sustainable enhancement of corporate value while promoting value sharing with shareholders.

- The remuneration system must be appropriate to the roles and responsibilities required of each director, and enable the Company to attract and retain excellent human resources to realize its goals.

- Incentive design for the Representative Director & President to create an environment that allows him/her to focus on improving corporate value over a long-term 10-year period (maximize the proportion of stock-based compensation).

With respect to stock-based compensation, the Representative Director, President & CEO will be granted “Post-Delivery Restricted Stock Units (RSU)” as compensation for the performance of his/her duties for 10 fiscal years, with the granted rights for the relevant fiscal year to be vested only when certain conditions are met each year. For directors other than the Representative Director, President & CEO, restricted stocks (RS) will be continuously granted and the calculation of the RSU will be determined by taking into account the Company’s stock price level in addition to the factors considered in the preceding paragraph. In principle, RS for each fiscal year is considered and determined by the first meeting of the Board of Directors following the Annual General Meeting of Shareholders, and the restricted transfer period is, in principle, 3 years.

After the voluntary Compensation Committee formulates a compensation proposal, the Board of Directors shall adopt a resolution on the proposal. For directors who are members of the Audit Committee, it is determined by consultation of the Audit Committee.

Remuneration

The total amount of remuneration for officers for the fiscal year ended July 31, 2025 was determined by the Board of Directors within the limit of the amount of remuneration approved at the General Meeting of Shareholders.

| Total amount of remuneration (JPY MM) |

Total amount of remuneration by category (JPY MM) |

Number of eligible directors/ auditors |

|||

|---|---|---|---|---|---|

| Basic remuneration | Performance linked remuneration | Non-monetary remuneration | |||

| Directors (excl. Audit & Supervisory Committee members) (Outside directors) |

193 (25) |

62 (16) |

- (-) |

130 (9) |

5 (3) |

| Directors (Audit & Supervisory Committee members) (Outside directors) |

37 (37) |

37 (37) |

– (-) |

– (-) |

4 (4) |

| Total (Outside directors/auditors) |

230 (62) |

99 (53) |

- (-) |

130 (9) |

9 (7) |

The total amount of remuneration for officers for the fiscal year ending July 31, 2026 and onwards will be determined by the Board of Directors after review by the Nomination and Remuneration Committee, within the remuneration limit approved by the General Meeting of Shareholders.

Accounting auditor remuneration

The company determines the remuneration to the accounting auditor with the consent of the Audit & Supervisory Committee.

| Period | Total amount of remuneration (JPY MM) |

|---|---|

| FY2023 | 52 |

| FY2024 | 55 |

| FY2025 | 63 |

Other matters related to corporate governance are set forth in the “Corporate Governance Code” and the “Criteria for Independent Judgment of Outside Directors”.

Risk management and compliance

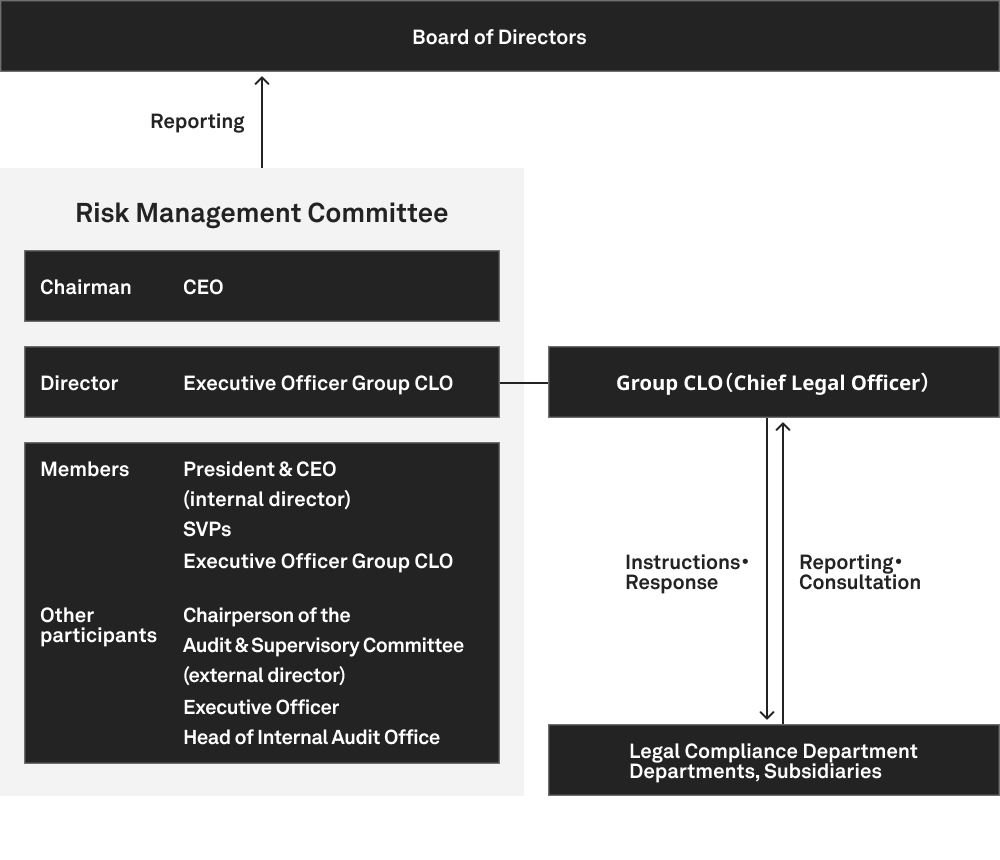

Risk management and compliance structure

We strive to promote compliance in accordance with our compliance regulation, which stipulates the compliance practice system and operations, as well as our compliance policy, which sets out a code of conduct for officers and employees. Compliance is promoted under the leadership of the Legal and Compliance Department of the Group CLO organization, which is responsible for overseeing compliance, in cooperation with each business division. The Risk Management Committee, chaired by the Representative Director, President, and Group CEO, meets quarterly with the participation of the SVP and Group CLO; the committee discusses and makes policy decisions on important matters related to compliance and anti-corruption. The committee reports not only on issues related to actual events, but also on near-miss events, and holds preventive discussions based on changes in social conditions and the business environment, thereby strengthening efforts to address compliance issues that have a significant impact on corporate value and stakeholders.We have adopted the Audit & Supervisory Committee for our corporate governance system.

Compliance training

In accordance with the annual compliance plan, we conduct training and officers and employees education programs on legal compliance and anti-corruption. In addition, based on the business environment and service content of each division, we also conduct individual training as needed on specific themes faced in daily operations to acquire the necessary compliance knowledge and raise awareness of compliance in the course of business.

As the scale of the Group organization expands, it is important that the officers and employees continuously receive appropriate programs in a timely manner. In addition to our existing compliance training by in-house instructors, we introduced an e-learning compliance training system to expand our educational and awareness-raising activities. By fostering compliance awareness among the officers and employees, we aim to further improve our corporate value so that our stakeholders can engage in business with us with peace of mind.

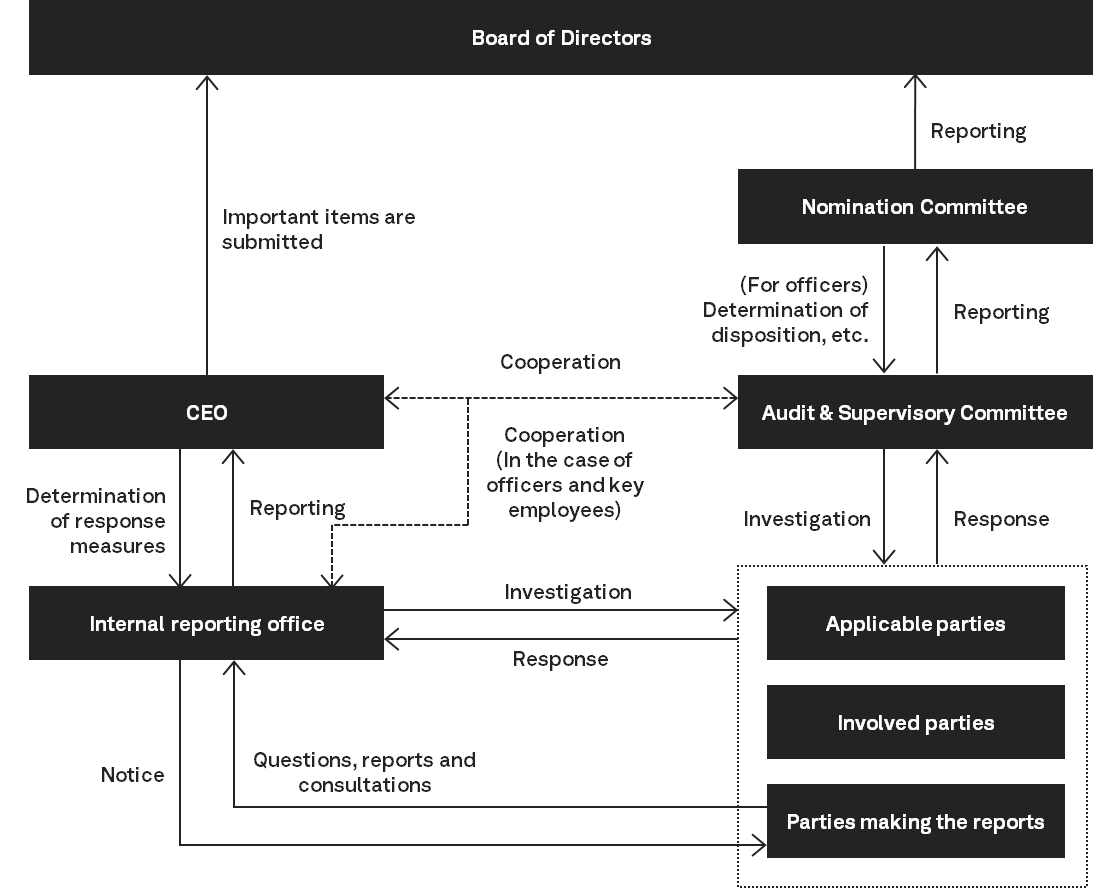

Internal reporting system

We have established three points of contact for internal reporting system for the early detection, correction, and resolution of legal violations and irregularities:an internal contact point, a contact point for Audit & Supervisory Committee members, and an external contact point (law firm); we have ensured that all officers and employees are aware of these contact points. In addition, the “Internal Reporting Regulations” explicitly stipulate that no disadvantageous treatment shall be given to any employee for making a report and that anonymous reports shall be accepted and kept confidential.

In the fiscal year ended July 2025, there were two reports and consultations received. The nature of these cases related to human rights and ethics.

Anti-corruption and anti-bribery

Anti-corruption

Anti-corruption policy

In accordance with our Corporate Compliance Policy (Raksul Group Code of Conduct), we, at RAKSUL Group, pledge to take part in a fair, transparent, and free competition, continue taking actions to stay just and honest and live up to the trust society places in us. To realize this pledge in more concrete terms, we have established and published an Anti-Corruption Policy, which clearly states our basic approach to preventing bribery and the rules that RAKSUL Group executives and employees must follow.

To prevent corrupt practices, we continuously examine, establish, and improve our anti-corruption management systems, taking into account country- and region-specific risks. The following practices are strictly prohibited:

(1) Corrupt practices such as bribery, illegal political contributions, donations, and sponsorships

(2) Providing improper financial or other benefits to customers or business partners to obtain or maintain trade or business favors

(3) Demanding or accepting financial or other benefits from public officials, customers, or business partners in exchange for business favors

Under this policy, we have established concrete internal rules regarding entertainment and business hospitality. Additionally, we have set up a compliance consultation and reporting channel to receive reports from our business partners, including suppliers. We recognize that maintaining fair and sound relationships with our business partners is essential for achieving sustainable business growth.

To ensure the effective implementation of this policy, we communicate its contents and related internal rules to all officers and employees through internal information-sharing and communication tools. Furthermore, we conduct regular internal training on legal compliance and anti-corruption measures. We also operate an internal whistle-blower system that allows anonymous reporting and ensures the protection of whistle-blowers. By raising awareness of this system, we enhance the effectiveness of our anti-corruption efforts.

For the fiscal year ending July 2024, there were no instances of legal sanctions, fines, or penalties imposed on our company due to bribery or other corrupt practices.

Contact for inquiries regarding Anti-Corruption

Please send us an email to our “Anti-Corruption Help Desk“

(Business hours: 10am-5pm JST, closed on Saturdays, Sundays, National Holidays, and New Year’s)

Anti-Social Forces

We have established the “Rules for Eliminating Anti-Social Forces” in order to block and eliminate any relationship with anti-social forces. These rules stipulate the basic policy for blocking any relationship with anti-social forces and preventing damage, and also establishing a framework for eliminating anti-social forces. We screen our business partners, officers, and employees with regard to anti-social forces, and introduce anti-social force exclusion clauses in the business terms of our policies and contracts.

Internal Control System

Basic Policy for the Establishment of an Internal Control System

In order to ensure the appropriateness of management, improve transparency, and ensure thorough compliance, we have established a “Basic Policy for the Establishment of an Internal Control System” at the Board of Directors meeting, and are working to establish and operate an internal control system.

Implementation of Internal Audits

We have established an internal audit department directly under the President and CEO, and this department conducts regular internal audits. Based on the “Internal Audit Regulations” and the annual internal audit plan, internal audits are conducted for each department, including the effectiveness of the internal control system, and the results of the audits are reported to the President and CEO on a regular basis, as well as to the Audit and Supervisory Board. In addition, the internal audit staff regularly exchange opinions with the Audit Committee and the accounting auditor, and work together by sharing information on issues and other matters among the three parties.

Furthermore, the internal audit plan includes a plan to conduct a compliance audit (implementation of compliance policies and anti-corruption policies) once every three years.

Information security

Approach to information security

As a company that handles customers’ confidential information, we consider the prevention of information security incidents to be our social responsibility. We will thoroughly manage information and aim to be a company trusted by our customers.

Security initiatives

We have established a Basic Policy for Information Security and are building an information security system.

We have established an Information Security Committee, and have acquired ISMS certification to continuously improve our information security management, as well as P Mark certification to protect personal information. In addition, we provide security training to our employees and undergo an external security audit at least once a year.