Since inception, our corporate activities have been guided by our vision of “Better Systems, Better World.” As a member of the society, we have been promoting ESG initiatives in order to realize a sustainable society. As part of the ESG initiatives, we have identified materiality (key issues) and “addressing climate change” is one of them. In April 2021, we expressed our support for TCFD* (Task Force on Climate-related Financial Disclosures) recommendations and joined the TCFD consortium**, which is comprised of companies and financial institutions etc. that endorse this initiative. In addition, we conducted a scenario analysis using the disclosure framework recommended by the TCFD from April 2022. We are committed to actively disclosing and enhancing information as we further strengthen our governance and business strategies on climate change.

* TCFD: Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB), an international body consisting of national financial authorities and international standard-setting bodies. This international initiative aims to support companies with climate related disclosure and to stabilize the financial market through a smooth transition to a low-carbon society.

** TCFD Consortium: An organization established in Japan in 2019 for the purpose of discussing effective information disclosure by companies and linking disclosed information to appropriate investment decisions by financial institutions and other organizations. Participants, such as companies and financial institutions supporting the TCFD, will proactively hold discussions on this topic.

Disclosures recommended byTCFD

(1)governance (2)strategy (3)risk management (4)metrics and targets concerning climate-related risks and opportunities.

In this document, we disclose climate-related information in regard to 4 recommended items.

- Governance

a) Board directors’ monitoring framework for risks and opportunities

b) Management’s role in assessing risks and opportunities - Strategy

a) Risks and opportunities for short/ medium/ long term

b) Impacts of risks and opportunities on the businesses, strategy, and financial planning

c) Resilience of organizational strategies considering scenario analysis - Risk Management

a) Process to identify and assess climate-related risks

b) Process to manage climate-related risks

c) Integration with the company-wide risk management - Metrics and Targets

a) Metrics to manage climate-related risks and opportunities

b) Greenhouse gas emissions

c) Targets and achievements

(1) Governance

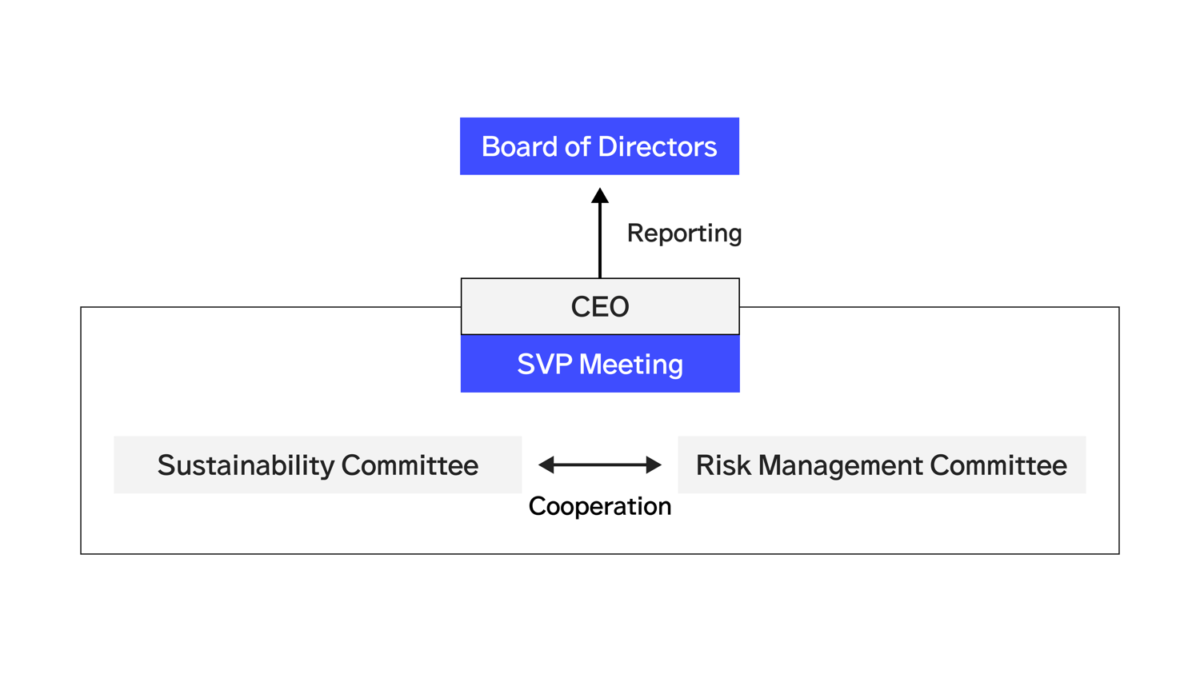

At RAKSUL INC., our Sustainability Committee discusses our policy on climate change and our responses to important issues, and reports annually to the Board of Directors on the status of such responses and particularly important matters, and monitors them under the direction and advice of the Board of Directors.

(2) Strategy

We conducted an analysis of the impact of climate change on our business by forecasting changes in the external environment in 2030 using a scenario analysis method based on the framework proposed by TCFD.

Subject of Analysis

The analysis was conducted for the RAKSUL business, which accounts for 80% of our revenue.

Identification of Risks and Opportunities

We have identified potential risks and opportunities for our business due to climate change. Among these, we have identified items we consider to be of particular relevance to our business.

Scenarios

With the 1.5℃ and 4℃ scenarios in mind, we have considered the parameters and changes in society while referring to the scenarios published by various institutions.

| Scenarios | Overview | Main Referenced Scenarios |

|---|---|---|

| 1.5℃ Scenario | In order to achieve net zero CO2 emission and limit the global average temperature increase to 1.5°C above pre-industrial levels, policies and regulations in each country will be strengthened more than the 2℃ scenario, and environmental and climate change awareness in society will increase significantly compared to the current situation. | ・IEA World Energy Outlook 2021. Sustainable Development Scenario/ Net Zero Emissions by 2050 Scenario ・IPCC SSP1-1.9 |

| 4℃ Scenario | This is a scenario with the assumption that the announced policies will be realized in addition to those already implemented, and policies and regulations are expected to be weaker than the 1.5℃ and 2℃ scenarios. CO2 emissions are likely to increase in the foreseeable future, and social awareness of the environment and climate change will remain an extension of the current situation. | ・IEA World Energy Outlook 2021. Stated policies Scenario ・IPCC SSP5-8.5 |

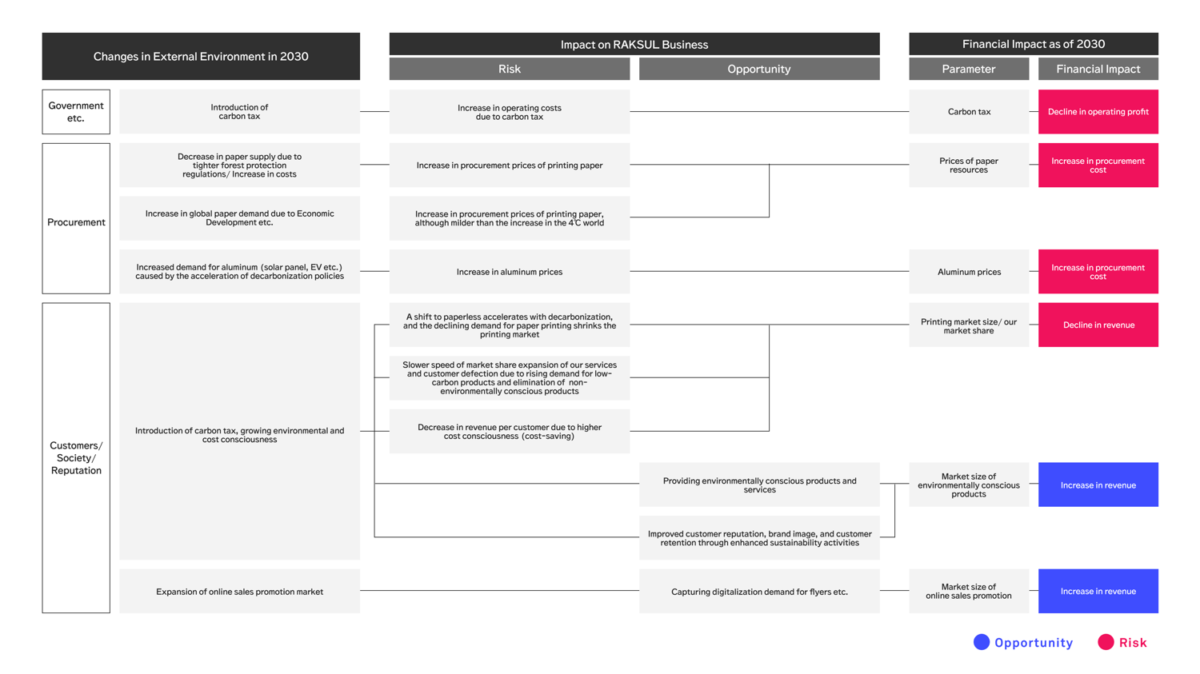

1.5℃ Scenario: Risks and Opportunities

| Categories | Items | Potential Financial Impact | Impact on RAKSUL INC. | ||

|---|---|---|---|---|---|

| Risks | Transition Risks | Policy/ Legal Risk | Increase in GHG emission prices | Increase in operating costs | ・The imposition of carbon tax will increase operating costs and squeeze operating profit. |

| Market Risk | Changes in customer behavior | Decreased demand for products and services due to changing consumer preferences | ・A shift to paperless will accelerate with decarbonization, which leads to declining demand for paper printing and a shrinking printing market. | ||

| ・Market share expansion of our services could slow down and we could lose some customers due to rising demand for low-carbon products and elimination of non-environmentally conscious products. | |||||

| ・Revenue per customer will decrease due to increased cost consciousness. | |||||

| Increase in raw material costs | Changes in composition and sources of revenue | ・Tighter forest protection regulations and decrease in paper supply will increase paper procurement costs. | |||

| ・Unstable oil prices caused by geopolitical risks will increase transportation costs. | |||||

| ・The acceleration of decarbonization policies will increase the demand for aluminum (solar panel, EV etc.) and the aluminum prices will go up. | |||||

| Opportunities | Products and Services | Consumer Trends | Changes in customer preferences | Increase in profits through enhancing competitiveness to reflect changing consumer preferences | ・We will provide environmentally conscious products and services in response to increased demand for products that respond to environmental changes. |

| ・Enhanced sustainability activities will lead to improved customer reputation, brand image, and customer retention. | |||||

| ・We will compensate for the decline in the paper printing market by offering services that capture the demand for flyers etc. that are increasingly going digital. | |||||

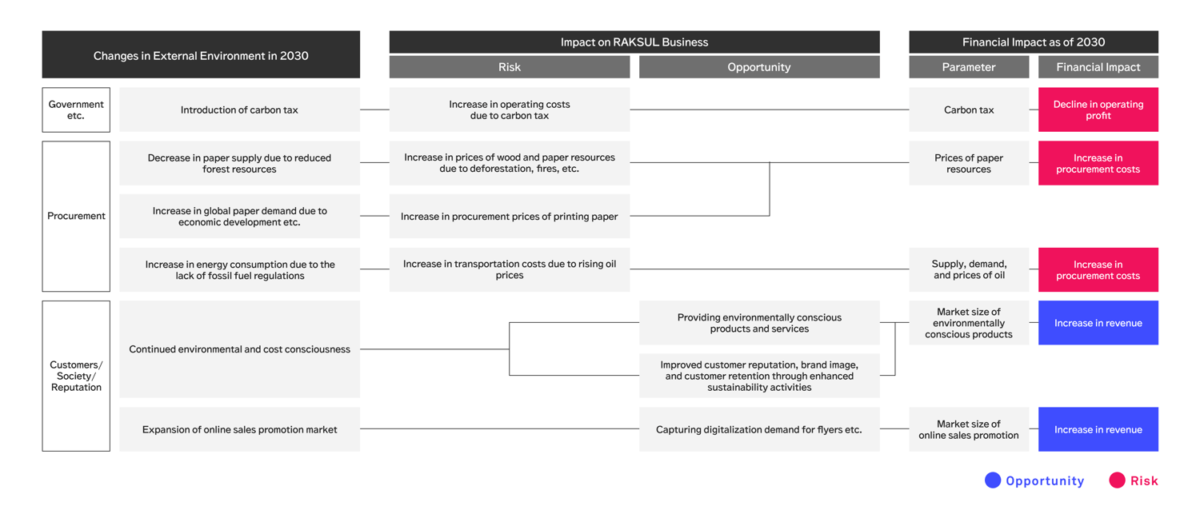

4℃ Scenario: Risks and Opportunities

| Categories | Items | Potential Financial Impact | Impact on RAKSUL INC. | ||

|---|---|---|---|---|---|

| Risks | Transition Risks | Market Risk | Increase in raw material costs | Changes in composition and sources of revenue | ・Escalation of oil prices in increase transportation costs. |

| Physical Risks | Acute | Increased severity of extreme weather events such as typhoons and floods | Decrease in profits due to transportation challenges and business shutdowns caused by supply chain disruptions | ・Due to damages to factories and disruptions of logistics caused by heavy rainfall and flooding, we could lose sales opportunities for products and services. In addition, inability to provide services could lead to decline in revenue and credibility. | |

| ・Due to heavy rainfall and flooding, costs related to taking care of damages to factories, disruptions of logistics, and securing personnel will increase. | |||||

| Chronic | Changes in precipitation patterns and extreme changes in weather patterns | Increase in operating costs | ・Prices of wood and paper resources will increase due to deforestation, fires, etc. | ||

| ・Rapid rise in temperature and power shortage will cause sudden increase in retail electricity prices and power outage, which lead to unstable factory operations. | |||||

| Opportunities | Products and Services | Consumer Trends | Changes in customer preferences | Increase in profits through enhancing competitiveness to reflect changing consumer preferences | ・Demand for products adapting to environmental changes will increase and we will provide products and services related to eco-friendly products. (i.e. increase the range of environmental papers etc.) |

| ・Enhanced sustainability activities will lead to improved customer reputation, brand image, and customer retention. | |||||

| ・We will compensate for the decline in the paper printing market by offering services that capture the demand for flyers etc. that are increasingly going digital. | |||||

1.5℃ World Scenario

The introduction of a carbon tax is expected to increase operating costs and decrease operating profit. In addition, procurement costs for printing paper are expected to increase with stricter regulations for forest conservation than today. Increasing environmental and cost consciousness could accelerate a shift to paperless and a decline in the use of RAKSUL services, which could potentially lead to a decrease in revenue. On the other hand, there is an opportunity for revenue growth through providing environmentally conscious services, enhancing sustainability management, and with the advancement of online sales promotion.

4℃ World Scenario

Costs are expected to increase due to rising energy procurement costs caused by increased global energy use and rising paper cost due to deforestation caused by climate change. In addition, opportunity losses and energy supply instability are expected due to extreme weather conditions. On the other hand, there can be an opportunity for revenue growth through environmentally conscious services, sustainability management, and progress in online sales promotion.

Financial Impact Forecast on RAKSUL business in 2030 and Countermeasures

We evaluated the impact on RAKSUL business. With the baseline of planned operating profit figures for 2030, we estimated the risk items with significant financial impact that can be quantitatively assessed, for each 1.5℃ and 4℃ scenario. We believe that we will be resilient under all scenarios as we will be taking measures to reduce risks for the risks identified and assessed in the scenario analysis.

| Items | Financial Impact | Impact Assessment for 2030 | Impact Level* | Our Response | |

|---|---|---|---|---|---|

| 1.5℃ Scenario | Risk | Increase in operating costs due to carbon tax | A carbon tax will be introduced and cause some financial impact based on emissions. | ー | Although the impact will be minor considering our emissions, we will take appropriate decarbonization measures. |

| Risk | Increase in raw material costs | The promotion of forest DD will resolve the decline in raw material costs of paper caused by illegal logging, and paper resource prices will increase with the rising paper raw material costs. | ー | We will lower the impact of rising paper resource costs by implementing central purchasing. | |

| Risk | Increase in raw material costs | Paper material costs will increase due to an increased global paper demand. | ーー | ||

| Risk | Increase in raw material costs | Raw material costs for aluminum plates for printing will increase. | ーー | We will partially switch from conventional printers to digital printers that do not use aluminum plates. | |

| Risk | Decreased demand for products and services due to changing customer preferences | Revenue will decrease due to losing enterprise customers promoting decarbonization and reducing wastes. | ーー | We will capture demand for transitions into digital sales promotion services etc. With the investment into Peraichi, we will secure new revenue sources by enriching digital content for customer acquisition and expanding from the paper printing market to the customer acquisition market and peripheral domains of printing. By providing flyers that can measure effectiveness, we will provide high-value services to our customers. |

|

| Risk | Decreased demand for products and services due to changing customer preferences | The printing market (especially office printing) will shrink at an accelerated rate and the revenue will decrease. | |||

| Opportunity | Changes in customer preferences | Demand for Eco-Friendly Paper will increase. | ++ | We will capture demand and increase revenue by expanding the Eco-Friendly Paper lineup.. | |

| 4℃ Scenario | Risk | Increase in operating costs due to carbon tax | There will either be no implementation or at a minimum regulation level. | ー | Although the impact will be minor considering our emissions, we will take appropriate decarbonization measures. |

| Risk | Increase in raw material costs | Paper material costs will increase due to an increased global paper demand. | ーーー | We will lower the impact of rising paper resource prices by implementing central purchasing. | |

| Risk | Increase in raw material costs | Increase in transportation costs due to higher gasoline prices. | ー | We will reduce transportation costs by reviewing and adjusting tariffs. | |

| Risk | Increase in raw material costs | Deforestation and fires will decrease forest resources and pulp production, which leads to higher paper resource prices. | ー | We will lower the impact of rising paper resource prices by implementing central purchasing. | |

| Opportunity | Changes in customer preferences | Demand for Eco-Friendly Paper will increase. | + | We will capture demand and increase revenue by expanding the Eco-Friendly Paper lineup. | |

800MM JPY+: large

500-700MM JPY: medium

0-400MM JPY: small

*Impact Level (Negative: – Positive: +)

The number of symbols indicates the magnitude of impact on the business

(3) Risk Management

In order to appropriately and promptly respond to risks that could have a significant impact on management, RAKSUL INC. has established a Risk Management Committee chaired by the Representative Director & President to recognize and identify risks that need to be addressed in the course of business activities and to discuss countermeasures.

Risks and opportunities related to climate change are identified and evaluated by the department with jurisdiction over sustainability matters, with the cooperation of relevant departments within the company, and are reported to and proposed to the Sustainability Committee to promote a company-wide response to climate change. The Sustainability Committee works with the Risk Management Committee to analyze and understand the significant risks identified by the Sustainability Committee and integrate them into company-wide risks in order to reduce and prevent the risks.

(4) Metrics and Targets

We are committed to reducing greenhouse gas emissions in response to climate change. We will measure and disclose our greenhouse gas emissions and promote energy efficiency through designing environmentally responsible sharing platforms.

We are currently in discussion regarding CO2 reduction targets for Scope 1 and 2. In addition to contributing to greenhouse gas emission reduction for the overall value chain, we will continue our preparation on creating metrics for the medium-term target for CO2 reduction.

Please see below for GHG emissions over the years for Scope 1, 2, and 3.